The Costa del Sol has long been one of Spain’s most desirable regions, attracting millions of visitors and property buyers each year, many of whom rely on a trusted real estate agency Costa del Sol professionals recommend to navigate the local property market with confidence. Known for its Mediterranean climate, strong tourism sector, and international appeal, the region has evolved far beyond a seasonal holiday destination. Today, it is a serious consideration for investors seeking stable returns, lifestyle benefits, and long-term capital growth.

So, is Costa del Sol a good investment in the current market? This article explores property prices, rental demand, yields, risks, and future outlook to help you decide whether investing in Costa del Sol real estate aligns with your financial goals.

Stretching along southern Spain’s Mediterranean coastline, Costa del Sol includes popular destinations such as Málaga, Marbella, Estepona, Benalmádena, Fuengirola, and Nerja. The region benefits from a unique mix of lifestyle appeal and strong economic fundamentals.

Key factors driving investor interest include:

Unlike many seasonal markets, Costa del Sol has become a year-round destination, which plays a major role in sustaining rental income and protecting property values.

Over the past decade, Costa del Sol property prices have shown consistent growth, particularly in prime coastal and urban areas. While global events temporarily slowed activity, demand rebounded quickly, supported by international buyers and limited new supply in high-demand locations.

Key market characteristics:

Compared to other Mediterranean hotspots, Costa del Sol still offers good value when considering lifestyle, infrastructure, and long-term growth potential.

Rental demand is one of the strongest reasons investors consider Costa del Sol property. The region benefits from both short-term holiday rentals and long-term residential demand.

Costa del Sol is one of Europe’s most visited coastal regions. Properties near beaches, historic centres, and transport hubs often achieve high occupancy rates.

Benefits include:

However, investors must be aware of local licensing rules, which vary by municipality and are strictly enforced in some areas.

Long-term rental demand has increased significantly due to:

Long-term rentals offer more predictable income and lower management intensity, making them attractive for conservative investors.

Rental yields vary depending on location, property type, and rental strategy.

Typical gross yields include:

While yields may not be the highest in Europe, they are supported by strong capital appreciation and relatively low volatility.

Capital growth is a major factor when evaluating whether Costa del Sol is a good investment. Several long-term trends support continued appreciation:

Areas such as Málaga city, Marbella East, and Estepona have benefited from improved infrastructure and rising demand, contributing to steady price increases.

Many investors choose Costa del Sol for both financial returns and personal use. This dual-purpose appeal strengthens demand and reduces downside risk.

Lifestyle advantages include:

Properties that can be enjoyed personally and rented out when not in use often deliver better long-term value.

Spain remains one of the most accessible European countries for foreign property buyers. Non-residents can purchase property without restrictions, making Costa del Sol particularly attractive to international investors.

Advantages include:

Working with a trusted local agency such as Vivi Real Estate helps buyers navigate the process efficiently and avoid common pitfalls, especially for overseas investors unfamiliar with Spanish property laws.

Understanding costs is essential when assessing investment returns.

Typical expenses include:

Factoring in these costs ensures realistic expectations and accurate return calculations.

While Costa del Sol offers strong fundamentals, investors should also consider potential risks.

Common challenges include:

These risks can often be mitigated through careful location selection, compliant rental strategies, and professional guidance.

Some locations consistently outperform others due to demand, infrastructure, and lifestyle appeal.

Vivi Real Estate works across these key areas, helping investors identify properties that align with rental demand and long-term growth trends.

Short-Term vs Long-Term Investment Strategies

Choosing the right strategy depends on your objectives.

Short-term rentals suit investors seeking higher income and willing to manage seasonality and regulation.

Long-term rentals appeal to those prioritising stability, lower management requirements, and predictable cash flow.

Some investors adopt a hybrid approach, switching strategies depending on season, market conditions, and regulatory environment.

The long-term outlook for Costa del Sol remains positive. Key drivers include:

As climate, quality of life, and remote work trends continue to influence relocation decisions, Costa del Sol is well positioned to benefit.

Working With a Local Real Estate Expert

Navigating the Costa del Sol property market is far easier with experienced local support, especially for buyers considering Living on the Costa del Sol long term. Vivi Real Estate provides local market insight, property sourcing, and professional guidance across Málaga, Marbella, Estepona, and surrounding areas.

For overseas investors in particular, working with a knowledgeable local agency reduces risk, improves negotiation outcomes, and ensures a smoother buying process from search to completion.

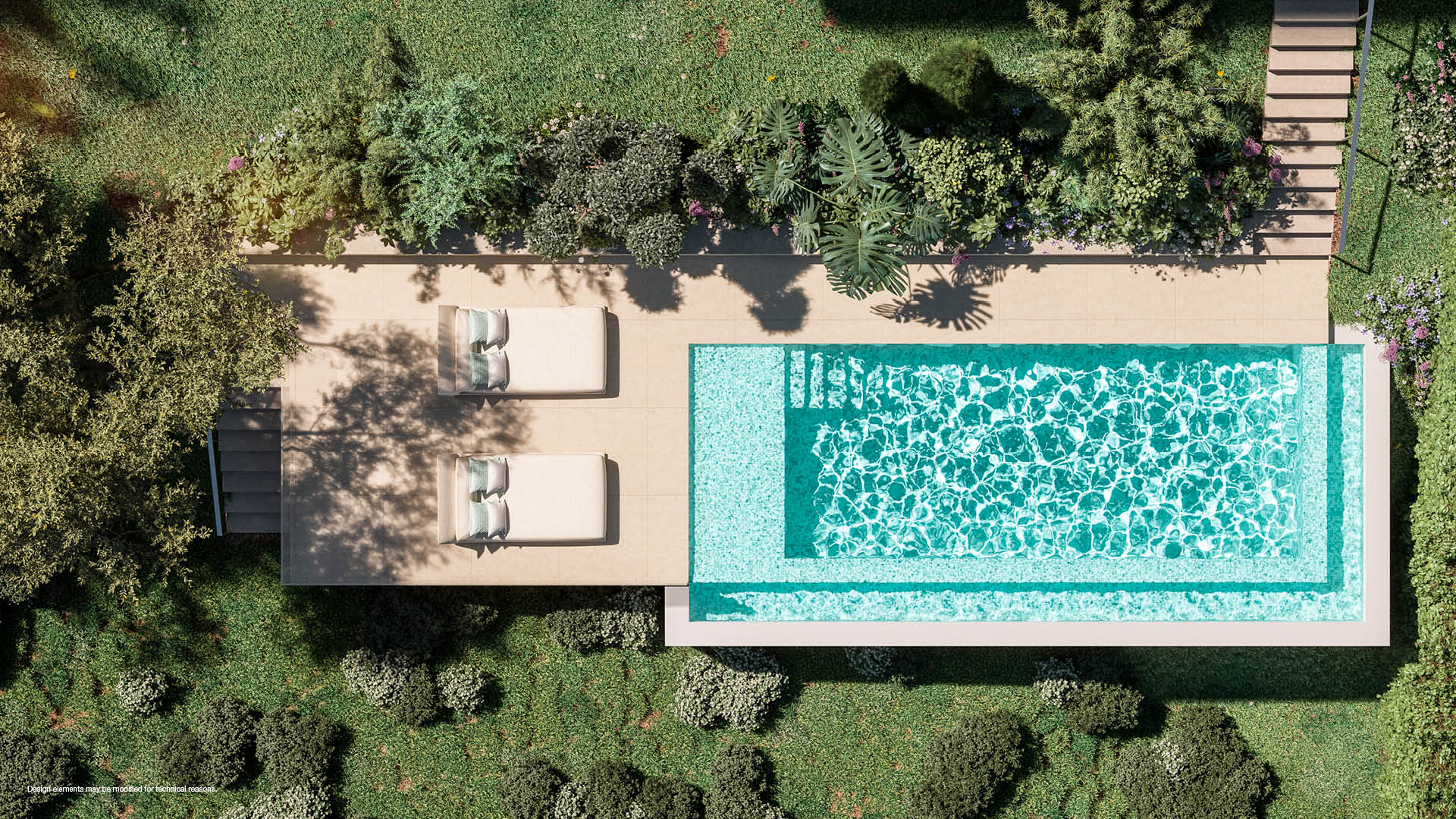

For many investors, the answer is yes, provided the investment is well planned. Costa del Sol offers a rare combination of lifestyle appeal, rental demand, and long-term growth potential. Beyond financial returns, opportunities for Sustainable Living on the Costa del Sol are growing, allowing residents to enjoy stability, eco-friendly amenities, and a balanced Mediterranean lifestyle. While it may not deliver the highest yields in Europe, it offers both resilience and quality of life that many investors value.

It is particularly suitable for:

Success depends on choosing the right location, understanding regulations, and aligning the investment with your financial goals.

So, is Costa del Sol a good investment? With strong international demand, diverse rental opportunities, and a proven track record of growth, Costa del Sol remains one of Spain’s most attractive real estate markets.

When approached strategically and supported by experienced local professionals such as Vivi Real Estate, investing in Costa del Sol property can deliver both financial returns and an exceptional Mediterranean lifestyle.